The Trust Grab - The Consolidation Within Transportation & Logistics

Rates are high, supply chains are twitchy, and customers have 0 patience for excuses.

The merger drumbeat you’re hearing is a scramble for proof: proof that networks hold under stress, custody is clean, and promised arrival times actually happen. Operators that can show receipts on reliability, compliance, and uptime are quietly setting the rules for everyone else. This blog digs into why that shift is accelerating now and where the next wave of winners will come from.

Commercial Aviation: Bankruptcy and Restructuring Pressure

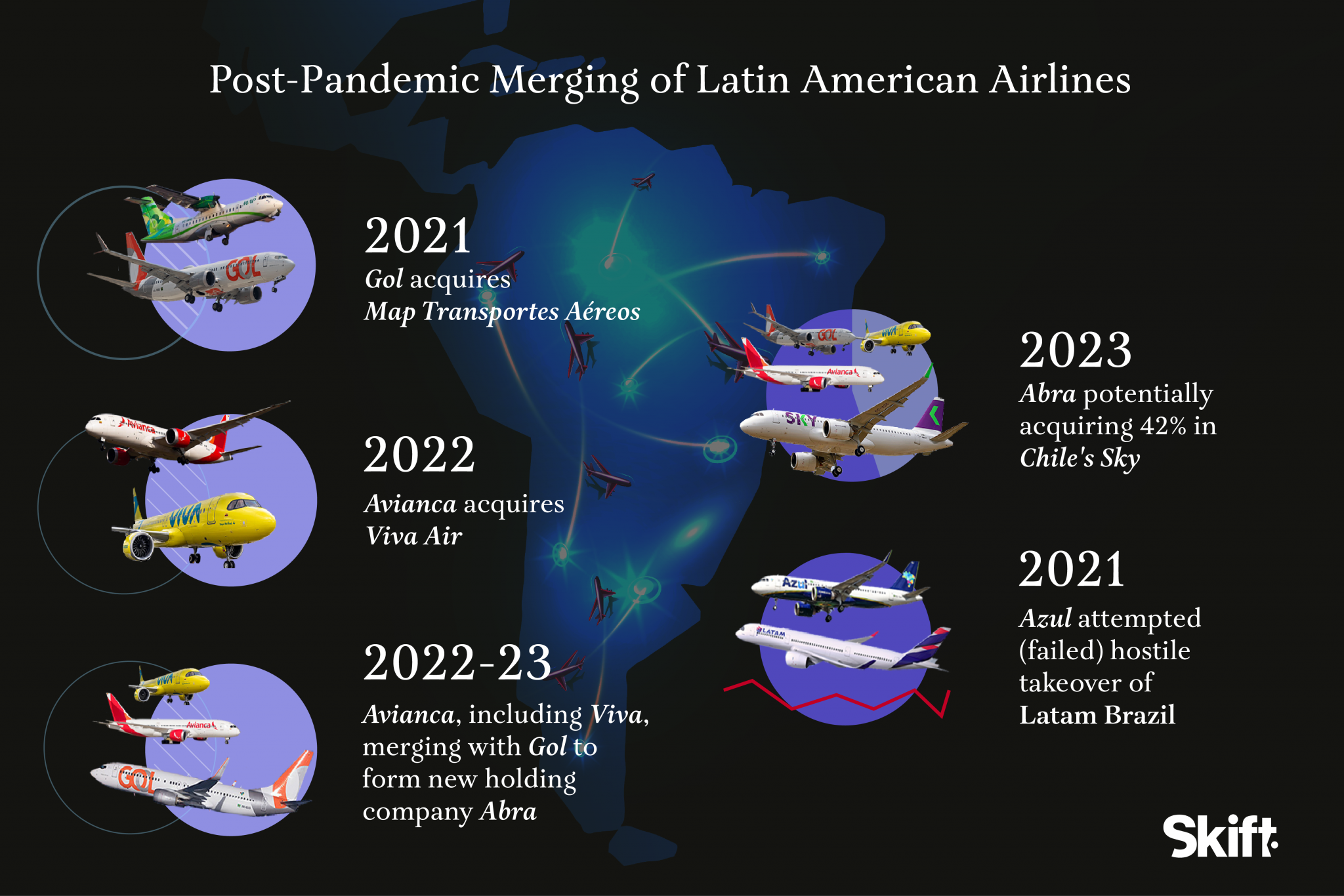

Latin America wrote the early chapter. Avianca and LATAM did not tiptoe through Chapter 11. They used it to cut real debt, simplify fleets, and re-emerge with liquidity to choose profit over vanity. That is the blueprint for a market where shocks last longer than a quarter. If you do not reset the balance sheet and the operating model together, the cycle will do it for you.

The Collapse Of Spirit

Spirit filed for Chapter 11 on November 18, 2024. Bondholders provided a $300 million debtor-in-possession (DIP) facility to bridge operations while the company negotiated with lessors and vendors. Spirit then emerged in March 2025, but the cash cushion and the quick legal win did not solve the core economics. The JetBlue deal had already been blocked by a federal judge in 2024, and the parties formally terminated the merger two months later, with JetBlue paying Spirit $69 million. The clean exit ramp was gone before the 1st case truly finished.

On August 29, 2025 Spirit filed again. In the weeks around the 2nd filing, management disclosed a 2nd DIP package of up to $475 million, with $200 million available immediately once the court approved it. Reuters put a number on the operating pain in the run-up to that filing: a Q2 net loss near $246 million and costs equal to about 118% of revenue, alongside an exhausted $275 million revolver. Those are not normal bad-quarter numbers; those are a business model that does not clear the new hurdle rate.

The AerCap settlement, approved October 10, 2025, shows how deep the reset has to go. Spirit will reject 27 existing leases and give up rights to 36 undelivered A320neo jets. AerCap keeps $9.7 million of deposits and can file an unsecured claim up to $572 million. AerCap also injects $150 million in cash and agrees to lease 30 new Airbus aircraft to Spirit for deliveries from 2027–2029. The company has already asked the court to let it reject 87 additional aircraft leases, and management is planning a fleet cut that takes the active fleet from around 214 aircraft toward roughly 114. That is a complete resizing, not a trim.

Engines made the operating side worse, and you cannot spreadsheet your way out of grounded metal. Pratt & Whitney geared turbofan inspections kept a significant slice of Spirit’s A320neo fleet on the ground, with media tallies in mid-2025 citing about 39 grounded frames. Spirit said it had received more than $150 million in credits tied to aircraft-on-ground days through late 2024, which helps liquidity but does not put an airplane back on the line tomorrow morning. When your product is time, compensation is not the same as completion.

The ULCC is not dead. It is maturing. Frontier leaned into perceived value and loyalty economics and told customers what they want to hear in 2025: cheap but not joyless. The company announced UpFront Plus and even first-class seats for late 2025, plus loyalty tweaks that make the fee ladder feel less punitive. That is not a costume change. It is an admission that after a pandemic and too many meltdowns, passengers want affordable that feels fair and dependable.

If your business model cannot carry the balance sheet through engine surprises, delivery delays, and a tougher DOJ, you will be re-sized to something that can. Harsh, yes. Also clarifying.

Freight, the transition from volume to validation

Shifting from commerical airlines to freights, one recent transaction says it clearly: UPS’s $1.6 billion acquisition of Andlauer Healthcare Group, announced in April 2025. The deal strengthened UPS’s healthcare logistics platform by adding 9 distribution centers and 22 branches across Canada, expanding temperature-controlled and last-mile capabilities across North America. For UPS, this was a strategic pivot toward high-margin, specialized logistics—segments more insulated from macro shocks and tariff volatility than traditional parcel delivery. For Andlauer, integration into a global operator provided capital support and digital infrastructure to scale faster. I find this compelling because it shows large carriers repositioning from volume-driven models toward specialized, service-intensive niches like pharma and medical logistics, where reliability and compliance are the key differentiators.

Logistics, Compliance As Moat And Density As Engine

On the logistics side, J.F. Lehman & Company announced in February 2025 its acquisition of Atomic Transport, and Houlihan Lokey was the sell-side advisor. Valued at roughly $250–300 million, the deal added Atomic’s 275-truck fleet and 30 terminals across 19 states, giving JFLCO exposure to a niche with stable, contract-based cash flow even as the broader freight market slowed. Atomic’s focus on bulk-material and waste logistics, which are regulated, non-cyclical services tied to municipal and industrial demand, made it a resilient asset amid volatile spot rates and tariff uncertainty. For the PE firm, the acquisition offered efficiency and cost synergies through shared fleet maintenance and route optimization, projected to lift margins from about 15% to over 20%. This shows how investors are gravitating toward specialized, compliance-heavy logistics platforms that generate steady returns and operational visibility despite broader sector headwinds.

T&L Global M&A Transaction Volume from Houlihan Lokey’s T&L 2025 Q2 Market Update

The Bipolar Future

This consolidation wave has a dual effect on T&L M&A. In the near term, tariffs, inflation, and policy uncertainty have tempered deal volume and valuations. Yet over time, these same forces are pushing the sector to evolve from broad-based acquisitions toward distressed or market-resilient niches such as healthcare logistics, temperature-controlled freight, and nearshoring supply chains to maintain a competitive position. I think it is an environment where transactions are fewer but more strategic, requiring investment bankers to act as long-term advisors who help clients adapt to an increasingly specialized and interconnected transportation landscape.