Boeing 2025 Q2 Earnings Recap

On July 29, Boeing shares dipped 4.37% even though the company delivered a well executed Q2 earnings release. The market’s reaction felt cautious rather than celebratory. Investors seem to want more proof that current momentum can overcome the well known speed bumps. My stance remains neutral.

Confidence in the 777X Program

The 777X still looks like a major revenue engine for Boeing over the coming years. Recent testing has been steady and routine rather than dramatic, which in this context is exactly what you want. The program passed more than 1,400 flights and 4,000 flight hours in the quarter without new technical issues surfacing. Inventory for the program has reached about $900 million as Boeing builds toward certification and entry into service. Work with the FAA continues to progress.

On the freighter side, the 777-8F also moved forward with the first hole drilled in the wing spar, a small but satisfying milestone that signals disciplined execution. Put together, the passenger and cargo versions give Boeing a path to serve both long haul travel and freight demand as these markets normalize.

Boeing Commercial Airplanes (BCA) Driving Growth

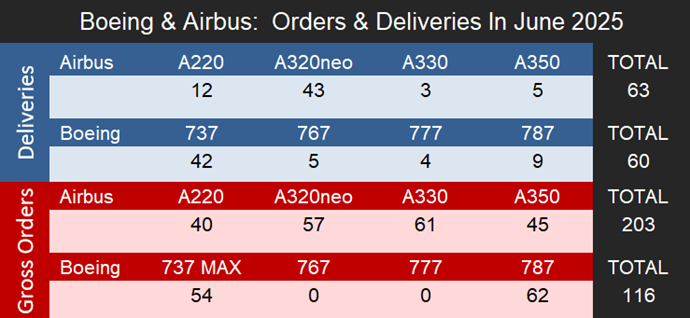

Commercial was the clear bright spot. BCA revenue climbed to $22.75 billion, up 35 percent year over year, powered by 150 commercial deliveries which is a 63 percent increase. That performance topped Wall Street expectations and helped margins inch higher as fixed costs spread across more units.

Orders were healthy with 455 net additions in the quarter. Boeing highlighted progress on its green KPI agenda, and the production tempo is building. The 737 line is running at about 38 per month and management plans to request 42 per month. The 787 is around seven per month. If those rates hold, cash generation improves. Q2 operating cash flow already turned positive and management sounded confident about positive free cash flow in Q4, with the CFO pointing to a full year figure around $3 billion.

One timing quirk matters for the sequence. Q3 will absorb a one time Department of Justice cash payment, which will dull the optics. Once that passes, the underlying cash profile should look cleaner in Q4 if deliveries remain steady.

Risks Around the MAX family

This is where the story still feels fragile. The certification path for the MAX 7 and MAX 10 has taken longer than anyone would like, and the anti icing design question is the latest reminder that timelines are not fully in Boeing’s hands. When investors hear that, the mood cools. These variants matter because they are expected to be richer on margin, so every extra quarter of waiting feels like a missed step.

Even so, I did not come away feeling that the narrowbody franchise is wobbling. The MAX 8 continues to carry the load, and management sounded steady rather than defensive. Still, until there is a firm green light on 7 and 10, the market will keep a raised eyebrow.

Labor Strike Adds Near Term Pressure

Labor is another area where sentiment can swing quickly. The recent rejection of a proposed contract that would have lifted wages by 20 percent over four years shows that expectations are running hot in the current environment. People remember how the 2024 strike forced large wage increases and dragged on the stock. With more negotiations ahead, including potential pressure in the defense unit next year, investors are bracing rather than relaxing. None of this says Boeing cannot manage through it, but it does color the backdrop with a little uncertainty.

Why Shares Still Felling?

Taken together, Boeing’s Q2 results were strong: higher deliveries, margin expansion, positive cash flow trajectory, and progress on flagship programs like the 777X. Yet the stock still dipped 4.37%. Why?

First, investors remain cautious about execution. The MAX 7 and MAX 10 delays are not new, but each quarter without progress chips away at confidence in Boeing’s ability to meet regulatory expectations. Second, the threat of labor strikes introduces uncertainty around costs and operational stability. Finally, the overhang of legal and settlement charges, such as the DOJ payment, clouds near-term free cash flow visibility.

Put differently, the market recognizes the underlying strength in Boeing’s portfolio but is not yet ready to re-rate the stock higher until these risks are better resolved.

Bottom Line - Neutral Position

From my perspective, Boeing’s Q2 earnings show a company that is moving toward recovery, but the path is not as exciting as the numbers might suggest. I believe that much of the optimism around aircraft orders and the cash Boeing collected in the first half of the year has already been priced into the stock. Without the 777X entering service, I do not see a strong new growth driver in the near term.

On the other hand, safety concerns have not completely disappeared, and labor strikes remain an unpredictable overhang. To me, these issues add uncertainty to Boeing’s story even when headline results look good.

Looking ahead, if the 777X program can reach delivery without further delays, I expect the stock to move within a trading range but not see a major breakout before 2026. For that reason, I remain neutral on Boeing and would rather wait for cleaner execution and fewer external risks before turning more positive.